Do you require assistance in locating jobseekers? If this is the case, don’t worry; we’ve got you covered. Take a look at this FREE Financial Analyst Job Description Template below.

If you’re ready for a new adventure with us, stay, and let’s learn together.

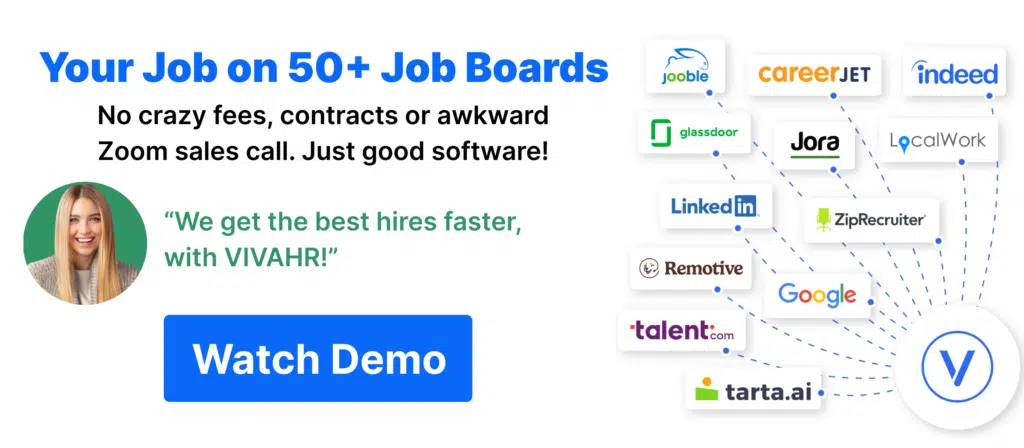

With VIVAHR software, you’ll be able to keep track of your data and hiring process.

First, compile a list of specific job criteria and responsibilities and come up with a compelling job ad introduction.

This strategy may increase your chances of finding the ideal person for your available position!

Ready? Let’s go! 🙂

What is a Financial Analyst?

A Financial Analyst is a professional responsible for analyzing financial data, trends, and performance to help businesses make informed investment and financial decisions. Financial analysts work in banks, consulting companies, mutual funds, and enterprises to develop sound investment strategies and promote overall financial development and stability.

They evaluate financial statements, market conditions, economic indicators, and investment opportunities to provide insights on profitability, risks, and future projections. Financial analysts often prepare reports, forecasts, and models to support management in strategic decision-making.

They can work in various industries, including investment banking, corporate finance, asset management, and consulting. Their role is critical in helping companies manage their finances, allocate resources efficiently, and maximize returns while mitigating financial risks.