When you are looking for a new employee for your business, there are a few things that you have to take into consideration. There are many desirable candidates for your job, but it is your duty to choose the best one. We are here to assist you in your hiring process and that is why we are offering you this FREE CPA Job Description Template. This template includes all the information that you need to know about the title of a CPA.

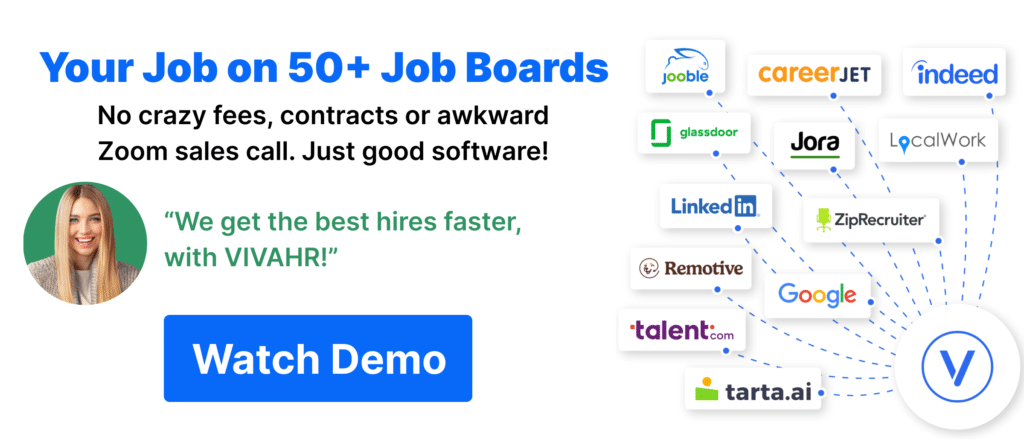

Feel free to customize and adjust this template according to your specific needs and requirements and it will be ready for posting on job boards and job posting sites.

We suggest using our easy and useful VIVAHR Software for a full hiring experience!

Let’s go! 🙂

What is a Certified Public Accountant?

A Certified Public Accountant (CPA) is a person responsible for assisting corporations, companies, or individuals to maintain and improve their financial reports, statements, and overall financial health.

They study, update, prepare, review, and analyze financial reports, budgets, transactions, and taxes.

CPAs oversee daily transactions and recommend ways to improve financial health and procedures.

They are also responsible for conducting occasional audits to ensure accuracy in financial records, preparing and organizing tax forms, and checking for any financial issues or inconveniences.