Frequently Asked about Insurance Advisor

What is the career path for an Insurance Advisor?

The career path for an Insurance Advisor can vary depending on the level of experience and expertise they have.

Typically, an Insurance Advisor will start as an entry-level employee and work up the corporate ladder.

They may also choose to specialize in a particular area of insurance, such as property and casualty or health insurance.

What is the typical schedule for an Insurance Advisor?

The specific schedule for an Insurance Advisor is full-time, Monday through Friday.

They may also be required to work occasional weekends or evening shifts.

How can someone improve their chances of becoming an Insurance Advisor?

A few key things will help someone improve their chances of becoming an Insurance Advisor.

First, having strong customer service skills and building relationships with clients is crucial.

It is also essential to be knowledgeable about insurance products and be able to advise clients on the best options for their needs.

Finally, it is vital to be organized and efficient in work habits.

How can I find a qualified Insurance Advisor?

The best way to find a qualified Insurance Advisor is to ask your network for recommendations.

You can also search online job boards or professional associations for members who specialize in insurance advice.

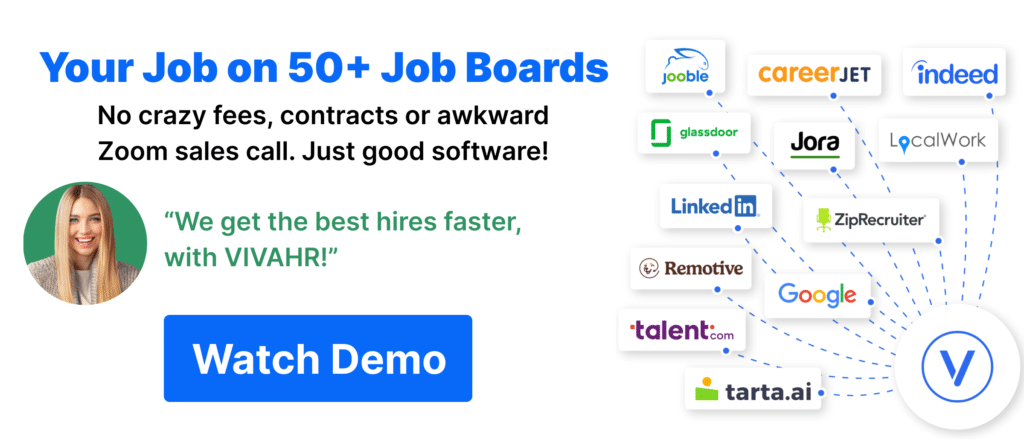

Furthermore, utilizing applicant tracking software expedites the hiring process by allowing you to streamline job postings efficiently, simultaneously distributing them across multiple job boards. As a result, you save both time and effort in your search for the most qualified candidates.