You’ve come to the perfect place if what you’re looking for is a new employee! We are dedicated to helping you conduct an easy hiring process. The primary item we offer you is this FREE Credit Specialist Job Description Template in which you will find every information you need to distinguish an appropriate candidate for this position.

We carefully selected and included the fundamental skills, educational and general requirements, responsibilities, and other details to help you hire an individual that best fits your business profile.

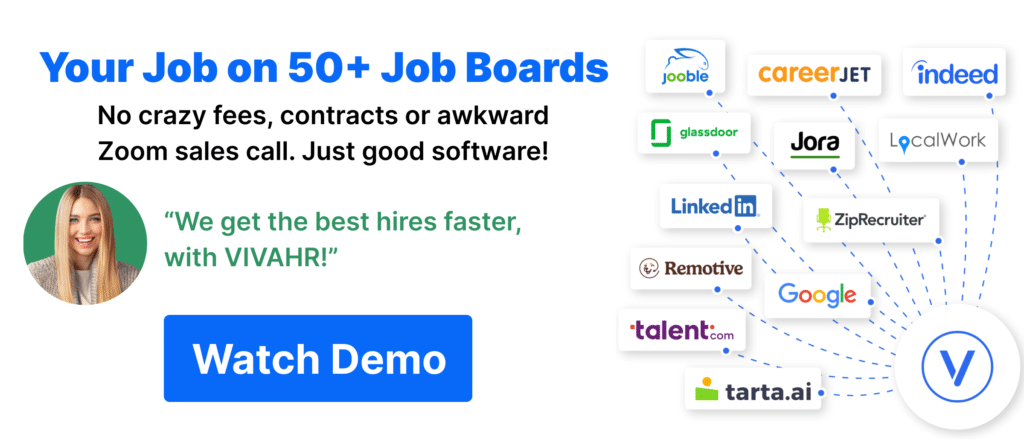

Once you start your hiring journey with VIVAHR Software, you will discover numerous other incredible business resources, features, and tools that can complement your overall hiring experience.

You can effortlessly customize job descriptions, create relatable and eye-catching job ads, and eventually distribute them to 50+ job boards across the country!

Your next A-player is waiting just around the corner!

Let’s go! 🙂

What is a Credit Specialist?

Credit Specialists perform comprehensive financial analysis on clients’ financial histories to determine whether they are liable and eligible candidates for loans or lines of credit.

They also receive and process credit applications and loan requests, check the accuracy of supplementary paperwork and assess and resolve credit-related issues and discrepancies.

Credit Specialists focus on providing assistance to clients regarding document preparation and loan closing, evaluate clients’ financial status, characteristics, and possible risks, and approve or reject loan applications based on clients’ financial information and liability.